Navigating Regulatory Challenges: A Guide for Fintech Startups in an Evolving Landscape

The fintech sector is no stranger to change. With innovation comes the challenge of adapting to the evolving regulatory landscape. As fintech companies introduce services and products they must carefully balance agility with compliance requirements.

The Importance of Meeting Regulatory Standards

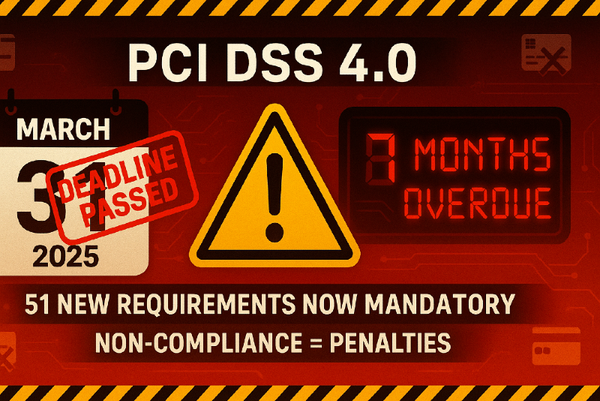

For fintech firms compliance is more than a checkbox—it's crucial for their survival. Failure to comply can lead to fines, legal disputes, damage to reputation and even the loss of licenses to operate. A recent study by Deloitte in 2023 revealed that global fintech firms faced over $2 billion in fines in a year highlighting the financial risks involved.

Adapting to Regulatory Changes

The regulatory framework governing fintech is dynamic and continuously evolving introducing guidelines in areas such as:

Data Protection: Regulations like GDPR in Europe have set higher standards, for safeguarding consumer data.

Anti Money Laundering (AML). Know Your Customer (KYC): Stricter measures are being implemented to combat crimes requiring robust verification processes.

Open Banking: While creating opportunities open banking rules also present challenges related to data security and sharing.

Real-World Examples: Lessons Learned

Robinhood: the known trading platform faced criticism and penalties, from authorities due to its use of gamification elements and lack of transparency in disclosing its order flow practices.

Revolut: A bank encountered delays in securing a banking license in the UK because of concerns surrounding its adherence to regulatory processes.

Wirecard: The payment company experienced a downfall stemming from accounting practices and insufficient oversight underscoring the serious repercussions of non compliance issues.

Navigating Through Regulatory Challenges: Tips for Fintech Companies

Proactive Communication: Initiate transparent dialogues with regulators. Seek guidance clarify expectations and foster positive interactions.

Invest in Compliance Know How: Establish a compliance team. Collaborate with seasoned consultants to ensure full adherence to regulations.

Advanced Technological Solutions: Deploy state of the art technology tools for KYC verification transaction monitoring and fraud prevention.

Stay Updated: Stay informed about changes and emerging industry trends. Participate in industry gatherings attend webinars and subscribe to publications.

Embracing Self Regulation: Explore involvement in industry groups. Contribute to shaping practices and standards.

Implications for Businesses and Consumers

Although meeting requirements may appear cumbersome, at glance it ultimately serves the interests of both businesses and customers:

Businesses: Compliance fosters trust among customers, investors and stakeholders. Financial institutions manage risks. Prevent legal disputes.

Customers: benefit from protections that secure their information and shield them from fraudulent schemes.

Data driven analyses highlight the costs associated with non compliance.

Research conducted by LexisNexis Risk Solutions revealed that on average financial institutions invest $3.1 million yearly in combating crimes.

Another study, by Thomson Reuters indicated that these institutions lose around 5% of their revenue to fraud.

The repercussions of compliance extend beyond monetary losses affecting customer relationships and business reputation in the long term.

Moving forward requires a balance between innovation and adherence to regulations for the fintech industry. Despite appearing restrictive compliance acts as a driving force for development. By addressing requirements fintech startups can establish credibility mitigate risks effectively and unleash their full potential.

Lets continue this discussion further. Feel free to share your insights on how fintech companies can navigate challenges. Have you encountered any achievements or obstacles, in this regard? Share your experiences with us in the comments !

P.S. Whenever you're ready, this is how I can help you:

1-on-1 Call with me : If you want to solve your Payments challenge quickly, get direct answers, develop a Strategy, validate your idea, or discuss a product feature. Book a 1-on-1 call with me.