Unlocking the Future of Finance: The Rise of Embedded Finance

In todays evolving era the lines, between traditional financial services and our daily routines are becoming increasingly blurred. Picture effortlessly accessing services while shopping for groceries online arranging a ride or simply browsing through your social media platform. This showcases the impact of embedded finance—a trend that is reshaping how we manage our finances.

Understanding Embedded Finance

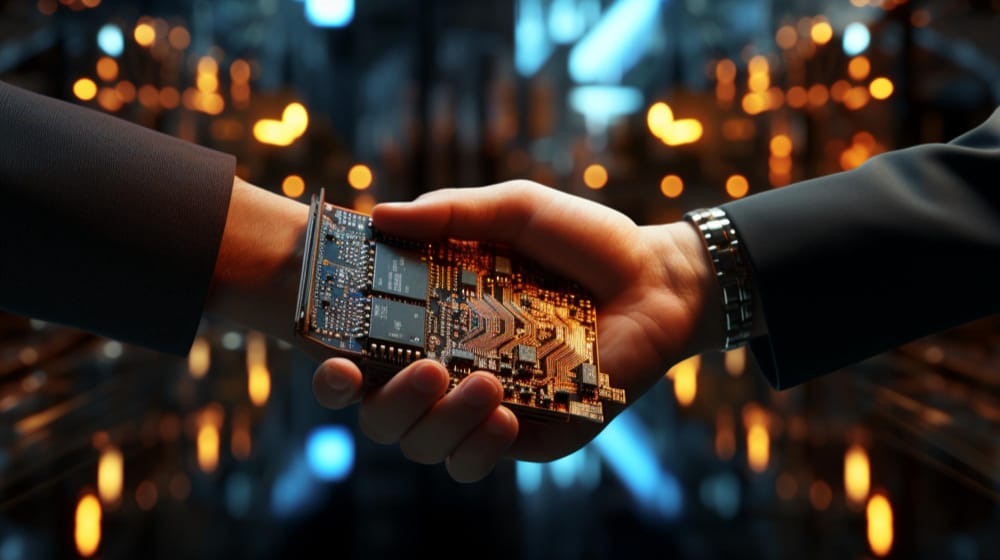

Embedded finance involves integrating services into financial platforms seamlessly incorporating banking and payment functions directly into the customer experience. This allows users to conduct transactions and utilize services like loans, insurance and investments without having to navigate from the platforms they already engage with on a regular basis.

The Surge of Embedded Finance

The growth of embedded finance is being driven by factors, including advancements in technology shifts in consumer behavior and the growing desire for digital interactions. Major players in e commerce ride sharing services and social networking sites are at the forefront of this movement as they recognize the benefits of providing services to their user communities.

Enhancing Convenience, for Users

Embedded finance brings convenience and accessibility to consumers. Just envision being able to split expenses with friends apply for a loan or make investment decisions—all within the app or website where you shop online connect with others socially or plan your travels.

This integration makes it easier, by avoiding the need to switch between platforms or apps enhancing the user experience and saving time.

Benefits for Businesses

Businesses can also gain significantly from incorporating services. By integrating these services into their platforms they can improve customer interaction boost revenue growth and set themselves apart in a market. Additionally embedded finance provides avenues for generating revenue and opportunities for monetization enabling businesses to tap into the financial services sector.

Obstacles and Factors to Consider

While embedded finance offers potential it comes with challenges that businesses need to address. These challenges include adhering to regulations ensuring data security and establishing infrastructure and partnerships to offer financial experiences.

Future Outlook

As embedded finance gains traction we anticipate witnessing innovation and disruption across industries. From tailored advice to payment solutions the prospects are limitless. Join us as we delve into the future of finance and explore both the opportunities and obstacles of embedded finance in our articles.

Subscribe for Updates

Stay informed about the insights and trends shaping the future of finance by subscribing to our newsletter. Receive content, expert analysis and practical strategies, in your inbox.