The biggest lie in fintech: "We encrypt all card data, so it's secure."

No. You're still storing the actual card.

I reverse-engineered Apple Pay's architecture to understand why encryption ≠ tokenization.

Here's what most payment startups get wrong:

Myth #1: "Encrypted cards are safe"

Encryption keys can be stolen. Databases get breached.

Apple Pay doesn't encrypt your card - it never stores it at all.

Instead: Device Account Number (DPAN) is generated once, real card discarded forever.

Hack Apple's system? You get useless tokens, not real cards.

Myth #2: "Biometric auth = secure payments"

Face ID proves WHO you are, not WHERE your card data lives.

Apple Pay layers three things:

→ Biometric authentication (who)

→ Secure Enclave hardware (where)

→ Tokenization (what)

Remove any one? Security collapses.

Myth #3: "We use the same tokenization as Apple"

Most fintechs: Server-side tokenization (card stored in cloud, then tokenized)

Apple Pay: Device-side tokenization (card becomes DPAN inside hardware chip, never touches servers)

Massive difference. One is vulnerable to breaches. One isn't.

Apple Pay's actual security stack:

Secure Element chip (hardware isolation)

DPAN generation (real card replaced)

Dynamic CVV (new code every transaction)

Cryptographic nonce (prevents replay attacks)

This isn't "better encryption" - it's architectural security designed so breaches don't matter.

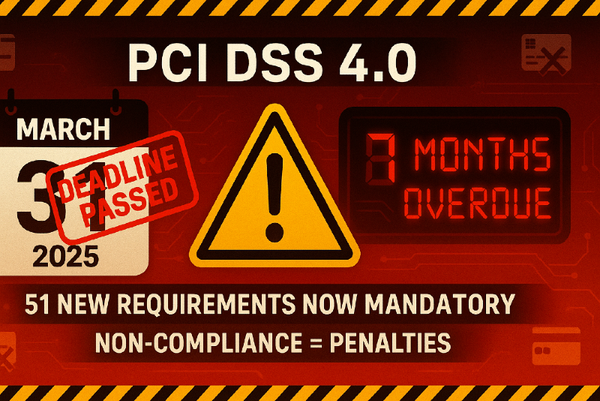

Why this matters for MENA fintech:

UAE payment apps need Apple-level security or consumers won't trust them.

But most are building:

❌ Software encryption (hackable)

❌ Server-side storage (single breach point)

❌ Static tokens (replayable)

What they need:

✅ Hardware isolation

✅ Device-bound tokens

✅ Zero plaintext storage

📎 Full technical breakdown + code: "Tokenized Trust - Apple Pay Case Study"

Hot take: If you're in fintech and haven't studied Apple Pay's architecture, you're building on guesswork.

This is the blueprint.