Revolutionizing Fintech: How AI and Machine Learning are Transforming Financial Services

The introduction of intelligence (AI) and machine learning (ML) has brought about a transformation in the financial technology (fintech) sector. These advancements are altering the way financial services are offered improving efficiency, security and customer satisfaction. Let's dive into the uses of AI and ML in fintech that are reshaping the industry.

Enhancing Fraud Detection and Prevention

A area where AI and ML have had an effect is, in enhancing fraud detection and prevention. Conventional rule-based systems often struggle to adapt to the changing strategies of fraudsters. In contrast, AI and ML excel at recognizing patterns and anomalies in time leading to effective identification and prevention of fraudulent activities.

Real Life Example

PayPal utilizes AI algorithms to scrutinize transaction data for trends. This enables them to identify transactions accurately safeguarding both the company and its clientele.

Customized Banking Services and Customer Support

AI-powered chatbots and virtual assistants are revolutionizing customer support through tailored interactions.

These tools utilize natural language processing (NLP) to comprehend and address customer inquiries offering round the clock support without the need, for involvement. This not only enhances customer satisfaction but also lowers operational expenses.

Real Life Example:

Bank of America's assistant, Erica utilizes AI to assist customers in managing their finances. Erica can offer insights into spending patterns propose money saving strategies and even handle banking tasks through a conversational interface.

Credit Evaluation and Lending

AI and ML are enhancing credit assessment models making them more precise and inclusive. Traditional credit evaluation systems often rely on data potentially excluding individuals with credit histories. Converse AI driven models can analyze an array of data sources such, as media activity transaction records and behavioral trends to evaluate creditworthiness more comprehensively.

Real Life Example:

ZestFinance employs machine learning algorithms for assessing credit risk. By scrutinizing data points ZestFinance can generate credit scores for individuals who might be disregarded by models thereby promoting financial inclusivity.

Automated Trading

In the investment sphere, algorithmic trading powered by AI and ML has revolutionized the landscape.

These advanced programs can assess market trends, historical information and even public sentiment to guide trading decisions with speed and precision surpassing abilities. This results, in markets and the potential for increased returns for investors.

Real World Example

Quantitative hedge funds such as Renaissance Technologies rely on AI to analyze data sets and execute trades swiftly. Their algorithms continually. Refine their strategies over time.

Managing Risks

AI and ML are also playing a role in risk management. By analyzing amounts of data these technologies can anticipate risks and recommend strategies for mitigation. This proactive approach assists institutions in handling risks effectively and meeting regulatory obligations.

Real World Example:

J.P. Morgan utilizes AI to scrutinize data from sources for risk identification and management purposes. Their COiN (Contract Intelligence) platform employs machine learning to examine documents and extract data points significantly reducing the time needed for compliance reviews.

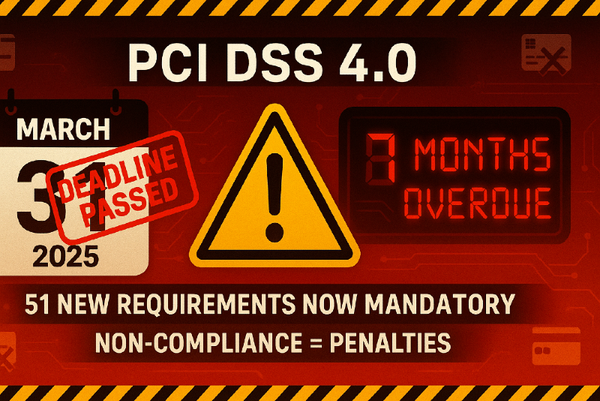

RegTech (Regulatory Technology)

Adhering to regulations poses a challenge for institutions. AI and ML are simplifying this process by automating compliance checks and monitoring transactions for infractions. This eases the workload on compliance teams while ensuring adherence to regulations, within timelines.

Real World Example:

Trunomi leverages intelligence to assist corporations, in handling customer data in accordance with data protection laws. Their platform automates the process of acquiring and managing customer consent ensuring that businesses adhere to evolving requirements.

In the realm of Financial Advisory and Wealth Management AI powered robo advisors are making financial advisory services more accessible to an audience. These platforms utilize algorithms to offer personalized investment guidance based on an individuals objectives and risk tolerance.

A real world instance includes Wealthfront and Betterment robo advisors that utilize AI for managing investment portfolios. These platforms consistently monitor market conditions. Adjust portfolios to maximize returns while aligning with the user's risk preferences.

The fusion of AI and ML in fintech represents not a passing trend but a fundamental shift within the industry. From bolstering fraud detection to tailoring customer experiences and refining investment strategies these technologies are driving enhancements in efficiency, security, and inclusivity. As AI and ML progress, their roles in fintech are poised for expansion introducing solutions.

For professionals and enthusiasts, in fintech keeping abreast of these advancements is essential. Embracing AI and ML has the potential to unlock opportunities and fuel growth within this sector.

Let's keep delving into and utilizing the power of these technologies to influence the direction of finance in the future.

PS: If you found this post insightful, don't miss out on future updates! Subscribe to our newsletter for FREE and stay ahead in the world of fintech:

P.S. Whenever you're ready, this is how I can help you:

1-on-1 Video Call with me: If you want to solve your Payments challenge quickly, get direct answers, develop a Strategy, validate your idea, or discuss a product feature. Book a 1-on-1 Video with me. [Limited Available Slots].