Real-Time Payments: Speed and Efficiency in the Modern World

In todays advancing era the key pillars of contemporary business operations lie in quickness and effectiveness. Real time transactions stand out as an element, in this evolution reshaping the dynamics of transactions, for both businesses and individuals. let's dive into the world of real-time payments, exploring their advantages, the technology driving this trend, and real-world examples backed by data.

Why Real-Time Payments Matter

Real-time payments (RTP) enable instant transfer of funds between bank accounts, available 24/7, 365 days a year. This shift from traditional batch processing to real-time transactions is reshaping the financial landscape in several ways:

Improved Cash Flow Management: Businesses can manage their cash flow more effectively with immediate access to funds. According to a survey by Aite Group, 78% of businesses reported better cash flow management with RTP.

Enhanced Customer Experience: Consumers enjoy the convenience of instant payments, reducing the wait time for transactions to clear. A Mastercard study found that 85% of consumers prefer businesses that offer real-time payments.

Reduced Fraud and Risk: Real-time payment systems often include advanced fraud detection and security measures, reducing the risk of fraudulent transactions.

Increased Operational Efficiency: RTP eliminates the need for manual reconciliation, reducing administrative costs and errors. Businesses can streamline their operations, focusing on growth rather than back-office tasks.

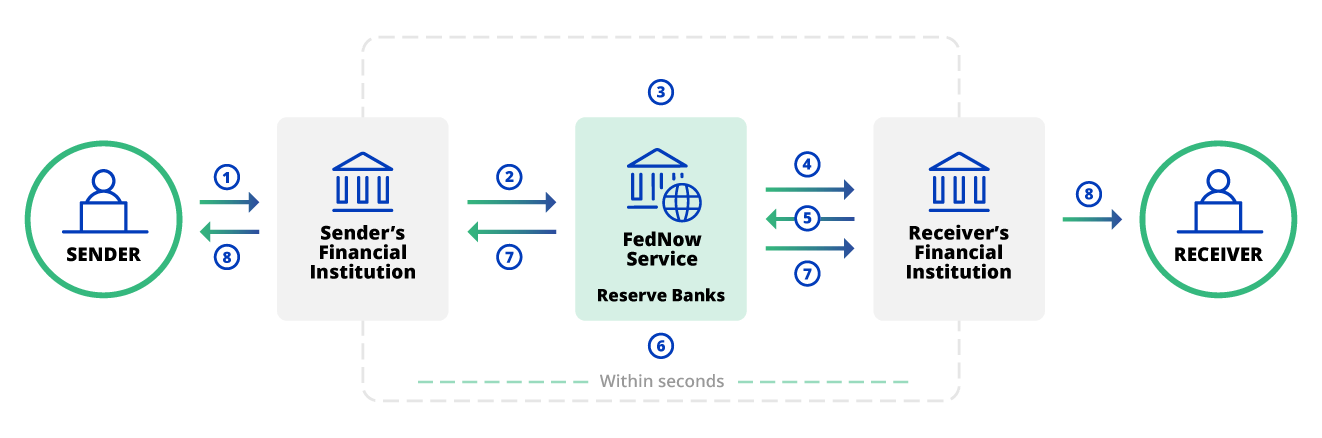

The Technology Behind Real-Time Payments

The backbone of real-time payments lies in advanced technology that ensures speed, security, and reliability. Let's break down the key components:

- Payment Gateways and APIs

Payment gateways facilitate the transfer of funds by securely transmitting payment information between the payer and the payee. APIs (Application Programming Interfaces) enable seamless integration between different payment systems, allowing for real-time processing.

Example: Stripe offers an API that supports real-time payments, providing businesses with the tools to integrate instant transactions into their platforms effortlessly. - Blockchain Technology

Blockchain offers a decentralized and secure method for processing real-time payments. It ensures transparency, reduces the risk of fraud, and speeds up the transaction process by eliminating intermediaries.

Example: Ripple's XRP Ledger allows for real-time gross settlement, currency exchange, and remittance through its blockchain technology, enabling fast and secure global payments. - Cloud Computing

Cloud-based payment systems offer scalability and flexibility, allowing businesses to handle a large volume of transactions in real-time. Cloud infrastructure supports high-speed processing and data storage, ensuring reliability and efficiency.

Example: Amazon Web Services (AWS) provides cloud-based solutions for payment processing, enabling businesses to scale their operations and process real-time payments efficiently. - Artificial Intelligence and Machine Learning

AI and machine learning enhance real-time payments by detecting and preventing fraud, optimizing payment routes, and improving transaction speed. These technologies analyze patterns and anomalies in real-time, ensuring secure and efficient payments.

Example: PayPal uses AI to monitor transactions in real-time, identifying and mitigating potential fraud before it occurs, ensuring secure payments for its users.

Real-World Examples and Statistics

Let's look at some real-world examples of how businesses and consumers are benefiting from real-time payments:

- Zelle

Zelle, a popular real-time payment service in the U.S., processed over $307 billion in 2020, with a 58% increase in transaction volume from the previous year. Its success lies in the instant transfer of funds between bank accounts, offering convenience and speed to consumers and businesses alike. - India's UPI (Unified Payments Interface)

India's UPI system has revolutionized payments in the country, processing over 2.2 billion transactions per month as of October 2020. UPI's success is attributed to its real-time processing, ease of use, and interoperability between different banks and payment services. - Faster Payments in the UK

The UK's Faster Payments Service (FPS) processed over 2.4 billion payments in 2019, with a total value of £1.9 trillion. The service has significantly reduced the time for fund transfers, enhancing the efficiency of payments for businesses and consumers.

Steps to Implement Real-Time Payments

For businesses looking to implement real-time payments, here are some steps to get started:

Assess Your Needs: Determine the specific needs of your business and customers. Identify the pain points in your current payment processes that real-time payments can address.

Choose the Right Technology: Select the appropriate payment gateway, API, or blockchain solution that supports real-time processing. Consider factors such as scalability, security, and ease of integration.

Integrate and Test: Implement the chosen technology and integrate it with your existing systems. Conduct thorough testing to ensure seamless operation and identify any potential issues.

Educate Your Team: Train your staff on the new system, emphasizing the benefits of real-time payments and how to handle potential issues.

Promote to Customers: Inform your customers about the new real-time payment options. Highlight the advantages, such as faster transaction times and enhanced security.

Monitor and Optimize: Continuously monitor the performance of your real-time payment system. Use analytics to identify areas for improvement and optimize the process for better efficiency and customer satisfaction.

Conclusion

Real-time payments are not just a trend; they are the future of financial transactions. By embracing this technology, businesses can enhance their cash flow management, improve customer experience, reduce fraud, and increase operational efficiency. As we move forward, the adoption of real-time payments will continue to grow, driven by advanced technology and the demand for faster, more secure transactions.

Let's embrace the future of payments and harness the power of real-time transactions to drive our businesses forward.

Until next time, stay innovative and keep pushing the boundaries of what's possible!