Integrating AI with Payment Gateways: Opportunities and Challenges

In the changing landscape of technology the incorporation of AI, into payment gateways opens up a new realm of opportunities. As AI continues to reshape industries its impact on refining and redefining payment systems is gaining importance. In this discussion, we delve into how AI's poised to transform payment processing and the distinctive possibilities and hurdles this integration brings.

Opportunities

Enhanced Detection of Fraud and Security Measures

One of the advantages of merging AI with payment gateways is the improvement, in detecting fraud and enhancing security protocols. AI systems can swiftly analyze transactions pinpointing patterns that may suggest behavior. By leveraging data AI can promptly identify irregularities in time minimizing false alarms and boosting the precision of fraud detection mechanisms. This not safeguards consumers. Also fosters trust in digital payment platforms.

Elevated Customer Experience

AI has the capacity to personalize customer interactions at every touchpoint. Through analyzing customer information and previous purchasing patterns AI algorithms can provide tailored payment solutions and recommendations greatly enriching user involvement and contentment.

For example AI has the ability to recommend the payment method, for a customer or offer personalized discounts and deals during checkout enhancing not the smoothness of the payment process but also making it more interactive.

Improving Payment Procedures

AI algorithms are adept at automating time consuming tasks. In payment gateways, AI can manage activities like verifying transactions assessing risks and conducting compliance checks with efficiency. This automation accelerates processing times reduces errors caused by humans and cuts expenses enabling businesses to expand without a significant rise in overhead costs.

Challenges

Privacy and Data Protection

The impressive capabilities of AI come with a responsibility to ensure data privacy and security. Since AI systems require access to data for functioning safeguarding this data becomes crucial. Companies must carefully balance utilizing data for AI purposes while upholding data protection standards to safeguard customer information from potential breaches.

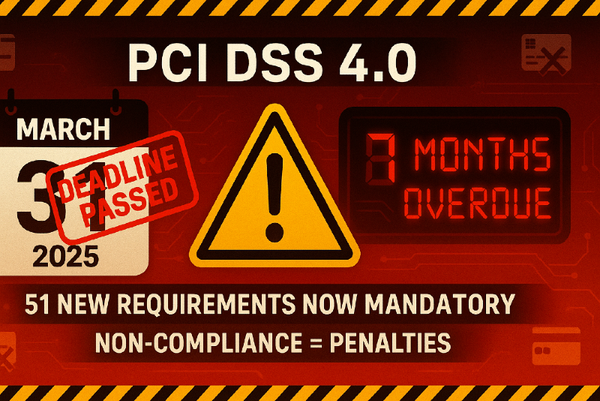

Meeting Regulatory Requirements

Integrating AI into payment systems must navigate through frameworks that vary by location. Adhering to regulations like GDPR in Europe or CCPA in California demands that AI systems not be robust but transparent and accountable, in their operations.

Ensuring that AI systems comply with these rules, especially regarding data usage and consumer rights presents a challenge.

Dependency and System Failures

Relying on AI systems can expose vulnerabilities, particularly when these systems face errors or malfunctions. The possibility of downtime or inaccurate decision making, by AI could disrupt payment procedures impacting transaction completions and potentially resulting in customer dissatisfaction and financial setbacks.

Looking Forward

The journey to fully incorporating AI into payment gateways is filled with both possibilities and significant obstacles. As we navigate this terrain the emphasis should be on utilizing AI to develop efficient and user friendly payment solutions while tackling the ethical and practical issues that emerge.

Embracing AI within payment systems goes beyond embracing technology—it involves advancing a vision where technology greatly enhances operational efficiency and consumer confidence. Through implementation learning and adaptable regulation AI can indeed deliver on its potential to transform payment gateways paving the way for future technological advancements, in the financial industry.