Enhancing Customer Experience with Seamless Payment Solutions

In today's fast-paced digital world, providing a seamless customer experience in payments is more crucial than ever. A smooth payment process can significantly impact customer satisfaction and retention. Let’s dive into some strategies to enhance the user experience in payment processes, from checkout to customer support, with real-world examples and data to back it up.

1. Simplified Checkout Process

Why It Matters: A complicated checkout process is a major turn-off for customers. According to a study by Baymard Institute, 21% of online shoppers abandon their carts due to a lengthy checkout process.

Strategy: Implement a streamlined, one-click checkout process.

Example: Amazon's one-click purchasing system is a prime example of this. By storing payment information and shipping details, Amazon allows customers to complete purchases with a single click, reducing friction and boosting sales.

2. Mobile Optimization

Why It Matters: With mobile commerce on the rise, ensuring your payment process is mobile-friendly is essential. Statista reports that mobile commerce accounted for 72.9% of total e-commerce sales in 2021.

Strategy: Optimize your website and payment gateways for mobile devices. This includes responsive design and mobile-friendly payment options like digital wallets (Apple Pay, Google Pay).

Example: Starbucks’ mobile app provides a seamless payment experience, allowing customers to reload their cards and pay for their orders through their smartphones. This convenience has led to increased customer loyalty and frequent usage.

3. Multiple Payment Options

Why It Matters: Offering a variety of payment methods caters to different customer preferences, reducing cart abandonment. According to a report by Worldpay, 42% of online shoppers prefer using digital wallets.

Strategy: Integrate multiple payment options, including credit/debit cards, digital wallets, and buy now, pay later (BNPL) services.

Example: Shopify merchants saw a 20% increase in conversion rates after adding PayPal as a payment option. This shows the importance of offering diverse payment methods to meet customer needs.

4. Transparent Pricing and Fees

Why It Matters: Hidden fees and unclear pricing can lead to distrust and abandoned transactions. Research by Statista indicates that 55% of shoppers abandon carts due to unexpected costs.

Strategy: Be transparent about all costs and fees throughout the checkout process.

Example: Klarna, a BNPL service, clearly displays any fees or interest rates upfront, building trust with customers and encouraging them to complete their purchases.

5. Efficient Customer Support

Why It Matters: Prompt and effective customer support can resolve payment issues quickly, maintaining customer trust and satisfaction. Zendesk reports that 82% of customers stop doing business with a company due to poor customer service.

Strategy: Implement a robust customer support system that includes live chat, FAQs, and a dedicated support team for payment-related issues.

Example: PayPal offers 24/7 customer support through multiple channels, including live chat, email, and phone support. This ensures that any payment issues are resolved quickly, maintaining customer confidence in the service.

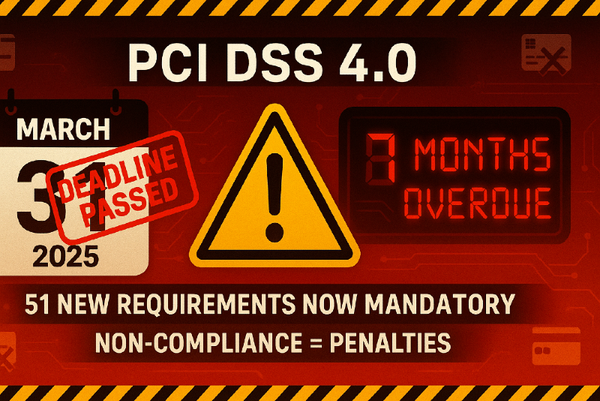

6. Security and Trust

Why It Matters: Security is a top priority for customers when making online payments. A survey by Experian found that 66% of consumers are concerned about the security of their online transactions.

Strategy: Implement strong security measures, such as encryption, two-factor authentication (2FA), and regular security audits.

Example: Stripe uses advanced encryption and tokenization to secure payment data. Additionally, it offers 3D Secure authentication for an added layer of security, ensuring customers feel safe when making transactions.

7. Personalization

Why It Matters: Personalized experiences can increase customer satisfaction and loyalty. According to Epsilon, 80% of consumers are more likely to make a purchase when brands offer personalized experiences.

Strategy: Use customer data to personalize payment experiences, such as saving payment details for faster checkouts and offering personalized discounts.

Example: Netflix personalizes the billing experience by offering different payment options based on user preferences and geographic location, making the payment process smoother and more user-friendly.

Conclusion

Enhancing customer experience in payment processes is not just about technology; it's about understanding customer needs and preferences. By simplifying checkout processes, optimizing for mobile, offering multiple payment options, ensuring transparency, providing robust customer support, and prioritizing security and personalization, businesses can significantly improve customer satisfaction and loyalty.

Let’s embrace these strategies and transform our payment processes to meet the evolving needs of our customers.

Until next time, keep innovating and enhancing those customer experiences!